Growth based on cumulative stock performance

- Principle 100% guaranteed**

- Interest paid at maturity

- Eligible for registered plans (RRSP, TFSA, RESP)

- No management fees

The Canadian Diversified Market-Linked Term Deposit differs from conventional term deposits in that interest is tied to the market performance of a basket of stocks (“benchmark securities”). This investment opportunity may be right for you if you are seeking higher potential returns while benefiting from principal protection with a three to five year investment horizon.

As shown in the table below, the rate of return is based on changes in the prices of the benchmark securities and could be nil at maturity. Your principal is guaranteed at maturity. As the performance of the benchmark securities increases, so does your rate of return – up to the maximum rates indicated.

As an example, for a three-year term deposit:

| Return (Interest) for a 3 year term deposit | 3 years |

|---|---|

| If the benchmark securities depreciate or appreciate by less than: …the return will be: | 0.00% 0.00% |

| If the benchmark securities appreciate between: …the return will be: | 0.00% and 15.00% The actual rate of return |

| If the benchmark securities appreciate by more than: …the return will be: | 15.00% 15.00% |

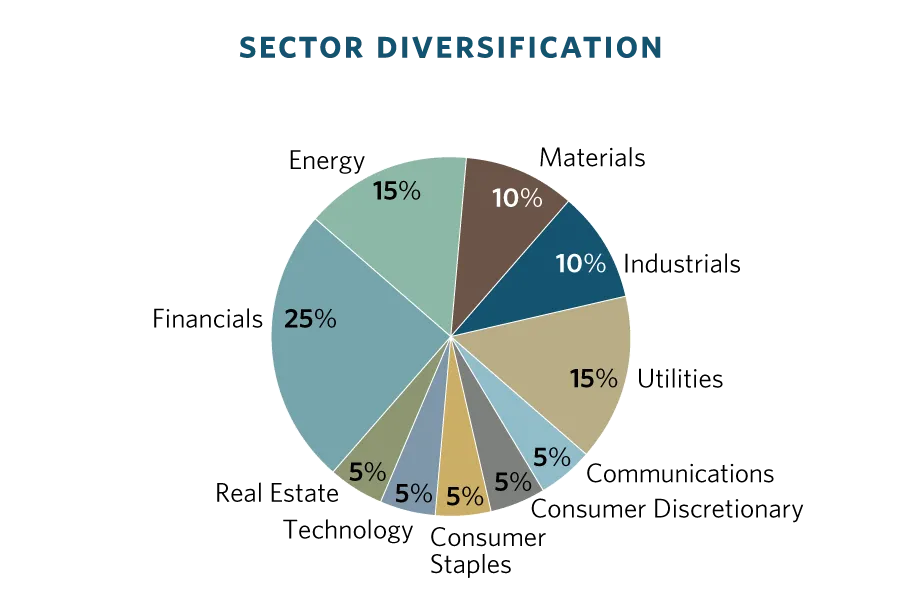

The Canadian Diversified Market-Linked Term Deposit is comprised of 20 Canadian companies representing a variety of economic sectors. Each company has the same weight in the basket:

| Average annual return1 | Maximum annual compound return (current issue) | |

|---|---|---|

| Canadian Diversified | 5.48% | 4.77% |

| The information provided is for informational purposes; past performance is not necessarily indicative of future returns. | ||

Our team of experienced professionals are here to answer any questions you may have.

** Eligible deposits are 100% guaranteed by the Credit Union Deposit Insurance Corporation of British Columbia (CUDIC).

¹ Please see Sales Agreement for details. Annual compound returns of the underlying basket values as of September 23, 2025.

² Maximum appreciation at maturity: This product has a ceiling that determines the maximum amount you may receive at maturity.

³ The indicated percentage represents the appreciation of the index in relation to its initial level. The appreciation takes into account the annual limits stipulated in the deposit agreement. The displayed return (not expressed as an annual compound return) shows the trend for the issue date indicated.