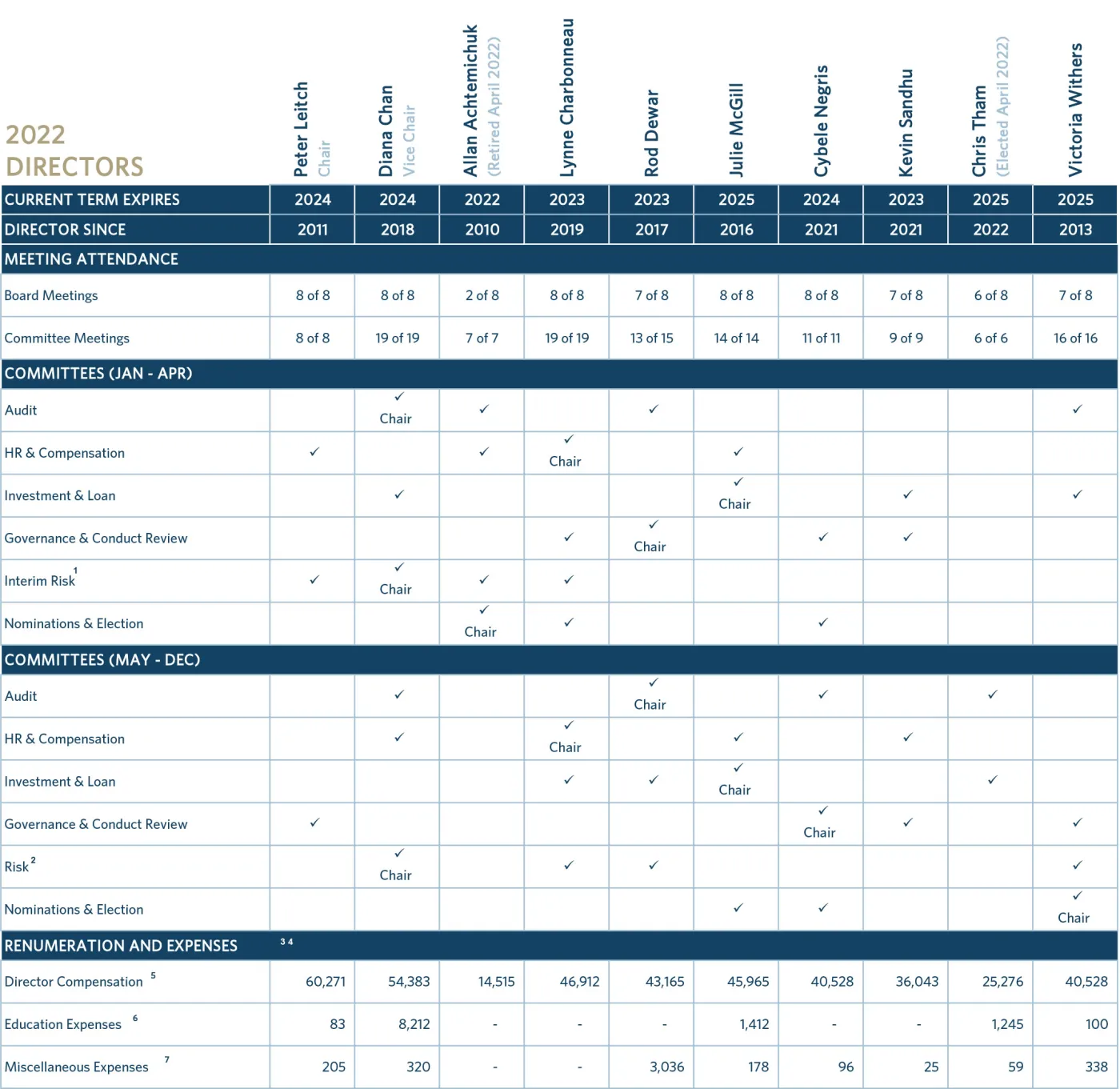

See the biographies for all of our Directors.

Governance Principles and Responsibilities

The Board continually reviews its corporate governance practices to ensure they reflect the highest level of oversight, independence and accountability our members and stakeholders expect and deserve. BlueShore Financial meets or exceeds the principles and standards set out in the BC Financial Services Authority (formerly Financial Institutions Commission) Governance Guideline, which ensures strong governance and risk management practices.

The primary responsibilities of the Board are to:

- Approve and monitor BlueShore’s adherence to its risk appetite and policies

- Approve and monitor BlueShore’s strategic plan and performance

- Ensure BlueShore’s risk governance framework is comprehensive, adequately resourced, forward looking, strategic, effective, diligently monitored and communicated

- Assemble an effective management team. This includes selecting a CEO, monitoring the CEO’s performance towards achieving mutually established objectives, and planning for the CEO’s succession

- Demonstrate accountability to BlueShore’s members and promote disclosure to allow members to engage with BlueShore as owners

- Be proactive in its own recruitment, composition, and performance management

Directors adhere to numerous Board policies, which are reviewed regularly to ensure they reflect current best practices. Directors also review key management policies, such as those pertaining to investment and lending, risk management, and whistleblowing to effectively manage the risk profile and performance of the Credit Union.

Director Education

BlueShore Financial places a strong emphasis on Director learning and development. In 2022, Board education sessions were held on the following subjects:

- Client Research

- Risk Maturity Roadmap

- Cybersecurity

- Competitive Barriers

- Business Continuity Planning

- Treasury

Directors are eligible for reimbursement of certain education expenses, in line with the Director Development and Education Policy. In 2022, Directors also pursued individual education opportunities through CUSource®, Watson Inc., Institute of Corporate Directors (ICD), and by attending industry conferences.

Board Evaluation

Individual Director learning plans are reviewed annually by each Director with the Board Chair as part of the Board evaluation and effectiveness process. A formal evaluation is conducted annually by a third party, which assesses the performance of the Board overall, including its Committees and the Committee Chairs. In addition, the Board reviews its performance at the end of every Board meeting without Management present.

Interlocking Directorships

Interlocking directorships occur when a director sits on more than one board at a time. In 2022, both Rod Dewar and Cybele Negris had a Director Interlock in common, as both were Board Directors of the British Columbia Automobile Association (BCAA).

Director Remuneration

BlueShore recognizes that corporate governance is a key ingredient to our success. Accordingly, there is a need to attract and retain Directors with appropriate expertise and experience, and remunerate them commensurate with their responsibilities, accountabilities, and expectations.

In 2021, the Board of Directors elected to defer their regularly scheduled review of the Director Remuneration Policy, due to the ongoing uncertainty caused by the global pandemic. In 2022, in recognition of increased workloads and the addition of a new Committee, Director Honorariums were increased in line with the 12-month average CPI in 2021 of 2.8% according to Government data. Typically, BlueShore’s Director remuneration will:

- Be set at such a level to be able to attract and retain the experience and expertise that our owners (members) and regulators expect for a financial institution operating in a complex and challenging environment.

- Recognize the workload and exposure to financial, reputational, and legal risks.

- Recognize the different workloads associated with Committee Members, Committee Chairs, the Vice-Chair of the Board and Chair of the Board.

- Broadly align with our comparator group, including similarly sized credit unions in Greater Vancouver, publicly listed companies with revenues of approximately $100 million annually, and other comparable co-operative organizations.

- Be reviewed biennially by the Governance & Conduct Review Committee of the Board to ensure it adequately compensates Directors for their responsibilities, accountabilities, and expectations. The Committee may review the policy more frequently on an as needed basis.

- Be reported annually in the BlueShore Financial Annual Report.

| Responsibility | Honorarium1 | Honorarium2 |

|---|---|---|

| All Directors | $ 30,693.64 per annum | $ 31,244.66 per annum |

| Board Chair | $24,739.60 per annum | $25,432.31 per annum |

| Board Vice-Chair | $6,187.44 per annum | $6,360.69 per annum |

| Audit Chair | $6,187.44 per annum | $6,360.69 per annum |

| HR & Compensation Chair | $4,505.96 per annum | $6,360.69 per annum |

| Investment & Loan Chair | $4,505.96 per annum | $6,360.69 per annum |

| Governance & Conduct Review Chair | $4,505.96 per annum | $4,632.13 per annum |

| Nominations & Election Chair | $4,505.96 per annum | $4,632.13 per annum |

| Risk Chair | N/A | $4,632.13 per annum |

| Committee Member | $1,976.12 per annum | $2,031.45 per annum |

1 Annual honorariums, in effect January 1 – April 31, 2022, which are cumulative and include meeting fees

2 Annual honorariums, in effect May 1 – December 31, 2022, which are cumulative and include meeting fees

1 The Interim Risk Committee ran from January to April, 2022.

2 The formal Risk Committee was inaugurated following the 2022 AGM.

3 Directors residing outside of BlueShore’s trading areas are eligible for reimbursement of travel and accommodation expenses.

4 Directors residing within BlueShore’s trading area, but 50km or more from headquarters are eligible for reimbursement of automobile mileage expenses to attend regularly scheduled Board and Committee meetings.

5 Director compensation includes per diems and technology allowances. The honorarium is intended to compensate for all Director work in the normal course of business, including meeting preparation and attendance, and the substantial interaction of the Directors with Management and other Directors in between meetings. However, a Committee Chair may request approval by the Board Chair for additional compensation in the form of per diems for Committee Members for significant extraordinary hours that may be required over and above normal expectations of the Committee, based on their terms of reference. Additionally, per diems are paid for attending regulatory required courses and approved conferences. In 2022, Interim Risk Committee members, including the Chair, were compensated for their meeting attendance via per diems, in addition HRCC members were compensated for additional Committee meetings. Per diems for the year were set as follows: up to two hours - $170; up to four hours - $345; over four hours - $560.

6 Education expenses include conference attendance and associated costs 7 Miscellaneous expenses include parking, lunch or coffee meetings, and mileage.